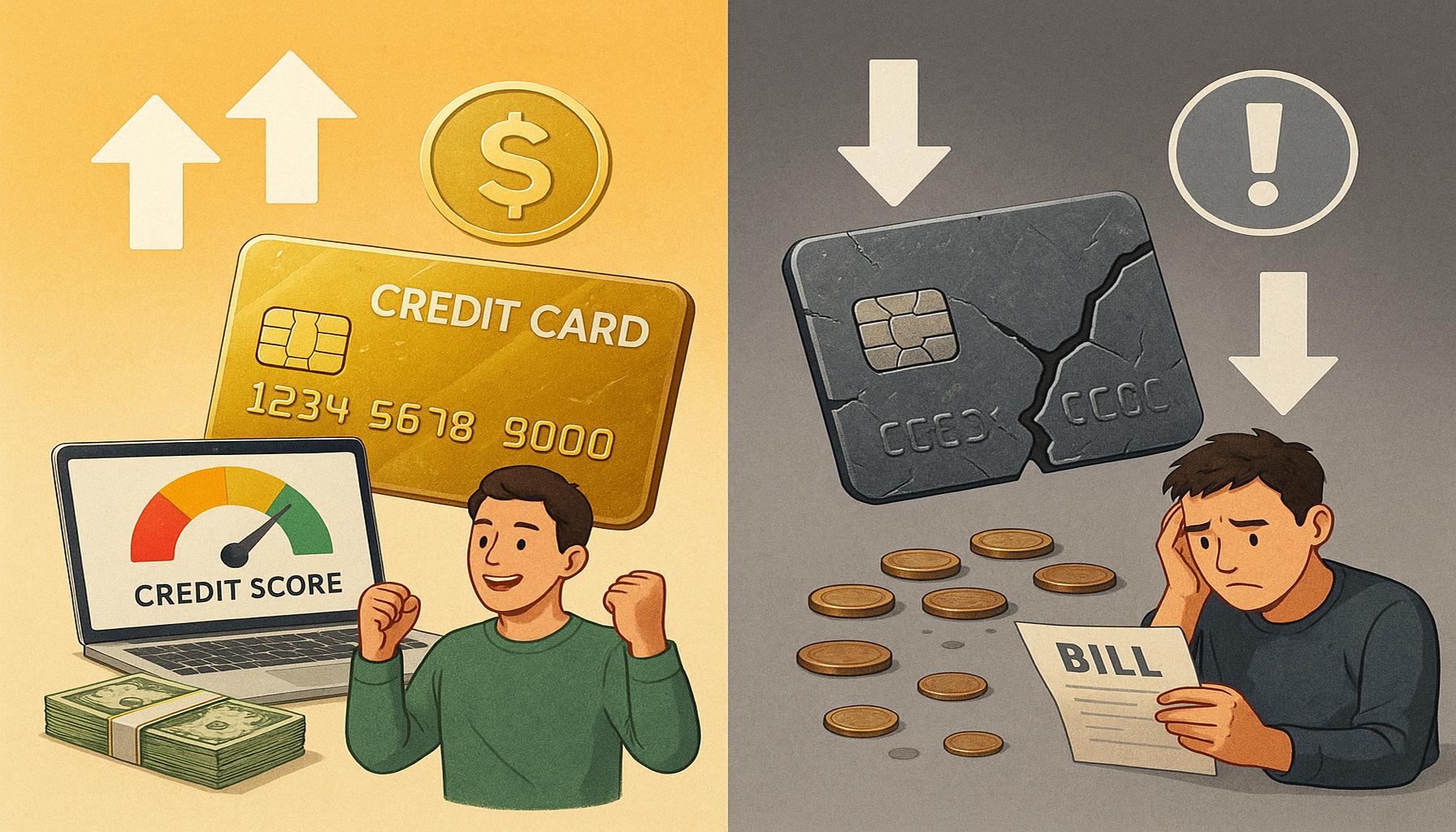

The Pros and Cons of Using Credit Cards for Credit Building

Benefits of Using Credit Cards

Credit cards can serve as an advantageous financial instrument if used judiciously. A prime benefit is the potential for a credit score boost. Each time you make a timely payment, it positively impacts your credit history, which is crucial as your credit score helps determine your eligibility for loans, mortgages, and other forms of credit. For young adults or those new to credit, responsible credit card usage can lay the groundwork for a healthy financial future.

In addition, many credit cards offer enticing rewards and benefits. Popular rewards programs include cash-back offers, where a percentage of your purchases is returned to you, and travel rewards that can lead to free flights or hotel stays. For instance, a credit card with a 1.5% cash back on all purchases can lead to significant savings if utilized for regular expenses like groceries and gas. Amazon Prime Rewards Visa Signature Card is a great example, as it offers 5% cash back on Amazon purchases, which can be immensely beneficial for frequent shoppers.

Furthermore, credit cards can provide essential emergency access to funds. In unexpected situations such as a medical emergency or urgent car repairs, having a credit card can prevent financial stress. This aspect can serve as a backup during tough times, allowing you to focus on immediate concerns without the burden of finding cash on short notice. By maintaining a good credit score, you can also access better credit limits, which can be saved for future investments or larger purchases.

Drawbacks of Using Credit Cards

Despite their advantages, the drawbacks of using credit cards warrant serious consideration. One significant concern is the potential for high-interest rates. If you carry a balance from month to month, you may find yourself facing interest charges that can quickly accumulate, leading to significant debt. According to the Federal Reserve, the average credit card interest rate hovers around 16% but can reach over 20% for those with lower credit scores. This accumulating debt can become a crippling cycle, making it essential to pay off your balance in full whenever possible.

The temptation to overspend presents another downside to credit card usage. With the convenience of swiping a card instead of parting with cash, many individuals may find themselves purchasing items outside their budget. This can lead to financial strain and increased debt. Consumers often need to exercise strict discipline to avoid the allure of ‘buy now, pay later’, a common mindset that encourages impulsivity.

Another drawback is how credit cards can impact your credit utilization. This ratio represents the amount of credit you’re using compared to your total available credit. Maintaining a low utilization rate—ideally under 30%—is crucial for a healthy credit score. High utilization can occur quickly if you’re not careful and can damage your score, making future borrowing more difficult and expensive.

Conclusion

As you navigate the complex landscape of personal finances, understanding the benefits and drawbacks of credit cards is imperative. By weighing these factors and adopting strategic approaches, such as maintaining low balances and choosing rewards programs that align with your spending habits, you can leverage credit cards to support your financial goals while avoiding common pitfalls. Knowledge and proactive management of your credit can turn this financial tool into a powerful asset.

DIVE DEEPER: Click here to learn more

Understanding the Benefits of Credit Cards

When considering the benefits of credit cards for credit building, it’s essential to recognize how they can effectively shape one’s financial landscape. One of the most noteworthy advantages is the ability to enhance your credit history. Credit scores, which typically range from 300 to 850, heavily rely on your payment history, credit utilization, and overall credit mix. Utilizing a credit card responsibly can create a positive feedback loop: timely payments boost your credit score, making it easier to qualify for larger loans in the future.

Moreover, credit cards often come with various perks and incentives that encourage consumers to use them wisely. Many issuers offer extensive rewards programs tailored to different spending habits. Examples include:

- Cash Back Rewards: Earning a percentage back on every purchase can lead to significant savings over time, particularly for regular expenses.

- Travel Rewards: Cards offering airline miles or hotel points can transform everyday purchases into unforgettable vacation experiences.

- Sign-Up Bonuses: New cardholders might receive a lucrative bonus after meeting a specific spending requirement within the initial months of opening an account.

Understanding these offers can help you choose the right credit card that aligns with your lifestyle. For instance, a consumer who frequently travels may find tremendous value in a card that provides travel points, while someone mostly shopping online might benefit more from cash rewards.

In addition to potential rewards, having a credit card can also serve as a critical financial safety net. Emergencies can arise without warning, such as medical expenses or urgent home repairs. In these situations, having access to credit can ease the stress of immediate financial obligations. This access can also provide a buffer, allowing you to manage cash flow without added pressure. It’s worth noting that responsible use of this credit can lead to higher limits in the future, opening doors to greater financial flexibility.

Let’s not overlook the importance of tracking your spending habits with credit cards. Many issuers provide monthly summaries that categorize spending, helping you identify areas where you may be overspending. Utilizing this information can be a unique opportunity to adjust your budget accordingly, ultimately contributing to better financial health.

While exploring the benefits, it’s crucial to keep an eye on how credit cards can affect your overall financial strategy. In an era where financial literacy is more important than ever, understanding these nuances can empower you to harness the full potential of credit cards while navigating the complexities of credit building.

LEARN MORE: Click here for a step-by-step guide

Exploring the Drawbacks of Credit Card Use

While credit cards can be a powerful tool for credit building, they are not without their drawbacks. Understanding these cons is crucial to navigating your financial landscape effectively. One of the most significant concerns is the potential for debt accumulation. Credit cards often come with high-interest rates, which can lead to a dangerous cycle of borrowing. If a cardholder fails to pay off their balance in full each month, the interest accrued can quickly mount, compounding existing debt and becoming financially burdensome.

According to a report from the Federal Reserve, the average credit card interest rate hovers around 16.61%, with many cards charging upwards of 20%. These rates can create a scenario where minimal payments barely scratch the surface of the principal amount owed. The more you owe, the more difficult it becomes to make timely payments, creating a potential spiral into financial instability.

Moreover, even if you manage to avoid debt, credit cards require discipline and careful management. The temptation to overspend can be overwhelming, especially when faced with promotional offers or rewards. Many consumers may find themselves purchasing items they might not usually buy just to meet spending thresholds or to accumulate rewards points. This behavior can lead to financial behavior that aligns less with needs and more with reward chasing, creating unrealistic spending habits.

Another critical factor to consider is the impact of credit inquiries. Each time you apply for a new credit card, a hard inquiry is made on your credit report. While a few inquiries may not drastically affect your score, too many within a short timeframe can signal financial distress to lenders. This could potentially lower your credit score at a pivotal moment when you might be aiming for a significant loan, such as a mortgage.

Time is another factor that plays a crucial role in credit building. Depending on your financial history, it can take a considerable amount of time to see a positive shift in your credit score from credit card usage. If you are new to credit building, you might find that it takes months or even years of responsible usage to establish a solid credit history. The delayed gratification of improved credit scores can test the patience of many consumers.

Lastly, it is vital to consider the potential impact of credit card fees and penalties. Many credit cards charge annual fees, foreign transaction fees, and late payment fees. Missing a payment deadline can lead not only to penalties but also to an increase in your interest rate, which may negate any benefits you gained from using the card responsibly. New users may often overlook these charges, which can detract from the overall advantage of building credit.

While it is essential to acknowledge the benefits of credit cards for credit building, it is equally necessary to be aware of the potential pitfalls. By understanding these drawbacks, you can make informed decisions on how to manage your credit responsibly and effectively.

DIVE DEEPER: Click here to learn how to build a resilient business

Final Thoughts on Credit Cards and Credit Building

In summary, utilizing credit cards for credit building presents a dual-edged sword. On one hand, they offer a viable pathway to establishing and enhancing your credit score when used responsibly—promoting financial opportunities like better loan rates and higher credit limits. On the other hand, the potential for debt accumulation is significant, especially with high-interest rates that can lead to financial distress if balances are not paid in a timely manner.

Furthermore, the discipline required to manage spending, along with the awareness of credit inquiries and potential penalties, means that entering the world of credit cards should not be taken lightly. It is essential for consumers to be informed and vigilant. The reality is that for many, building a solid credit history can be a gradual process, requiring patience and careful planning. Taking the time to understand the fine print of credit card agreements can save users from falling into costly traps.

As you weigh the options of using credit cards to build credit, consider your own financial habits and objectives. Seek out cards with favorable terms that cater to your spending patterns, and never hesitate to educate yourself on best practices for repayment and management. By striking the right balance, credit cards can be an effective tool in shaping a stronger financial future. Take the necessary steps today to ensure you build your credit wisely and set yourself up for long-term success.

Related posts:

Negotiation Techniques to Reduce Credit Card Limits and Control Spending

How to Apply for Chase Freedom Unlimited Credit Card Easily

Tips to Avoid Credit Card Debt and Manage Your Budget

The Role of Credit Cards in Managing Financial Emergencies

The Impact of Credit Card Interest Rates on Personal Finance

How to Apply for the Banana Republic Rewards Mastercard Credit Card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.